Why Are Homeowners Staying Put?

Why Are Homeowners Staying Put? A Look at Today’s Housing Market

Thinking about selling your home but hesitant to give up your 3% mortgage rate? You’re not alone — and the data backs up what you’re feeling. Fewer homes are hitting the market, and the numbers tell a compelling story. According to ATTOM, the average U.S. homeowner in 2025 has been in their home for 8.6 years, the longest tenure on record since 2000 (when it was just 4.2 years). This trend is playing out across nearly every major metro area.

The Mortgage “Lock-In” Effect - Interest rates are the primary culprit.

Millions of homeowners refinanced between 2020 and 2022 at historically low rates between 2.5% and 3.5%. Replacing that loan today at 6–7% would mean a significantly higher monthly payment — sometimes hundreds or even thousands of dollars more. This financial friction, often called the “lock-in effect,” makes selling feel less appealing for many homeowners.

The National Association of Realtors has tracked rising homeowner tenure since the 2008 housing crisis, as tighter lending standards and more conservative ownership patterns replaced the short-term speculation that characterized the previous era.

Structural Supply Constraints

Beyond interest rates, several other factors are contributing to longer tenure: Baby Boomers aging in place (many of them mortgage-free and comfortable in homes they’ve owned for decades), Millennials who bought later in life and were fortunate enough to lock in low rates, and a persistent construction deficit that’s been building for years.

Freddie Mac estimates the U.S. housing market remains undersupplied by millions of units, which continues to keep inventory tight nationwide.

Signs of Gradual Normalization

That said, there are early signs the market is recalibrating. Redfin reports that roughly 62% of buyers recently purchased below the original list price — the highest share since 2019. Realtor.com indicates that homeowners with mortgage rates above 6% now outnumber those below 3% for the first time since 2020.

As ultra-low-rate mortgages naturally cycle out over time, the lock-in effect should gradually ease.

Northern Nevada: Local Trends and Unique Advantages

Local trends mirror what we’re seeing nationally, but Northern Nevada has some distinct characteristics worth noting.

Data from the Reno/Sparks Association of REALTORS® shows that inventory remains below long-term norms, though it’s improved considerably from pandemic lows. Days on market have normalized to more typical levels, and median prices are holding relatively stable year-over-year, despite lower transaction volume.

What makes Northern Nevada different? The region continues to benefit from steady in-migration drawn by Nevada’s tax advantages — no state income tax is a powerful incentive for remote workers and retirees alike. Industrial expansion at the Tahoe-Reno Industrial Center, anchored by employers like Tesla, Panasonic, and Google, keeps employment strong and demand steady. Add in proximity to Lake Tahoe and year-round outdoor recreation, and you have a compelling value proposition.

Meanwhile, geographic constraints — mountains, federal land, and limited developable areas — naturally restrict new supply, which supports long-term value stability.

Bottom Line

The housing market isn’t stalled. It’s recalibrating. And that’s actually good news.

Extended homeowner tenure reflects real structural and financial factors, not market weakness. This isn’t a crisis. Inventory growth is likely to be gradual rather than sudden, and that’s a healthy sign for long-term stability.

For Buyers: Your Advantages

You have more negotiating leverage than you had two years ago. Sellers are more realistic. Inventory has improved. This is your moment.

For Sellers: Success Strategies

Disciplined pricing and thoughtful preparation are more essential than ever. The days of overpricing and getting away with it are over. Homes that are priced right and show well are still moving. Strategy matters.

If you’re thinking about making a move, or simply want to better understand where things stand, we’re always happy to be a sounding board. A complimentary market analysis can help put today’s numbers into context—no pressure, just clear, honest information. Sometimes that clarity is all you need to feel comfortable with whatever comes next.

Nanette, a fourth-generation Nevadan, brings decades of experience as a licensed real estate and business broker—one of the few to hold this designation—along with credentials as a mediator and arbitrator, and deep expertise in market analysis, negotiation, and professional standards across Northern Nevada.

Disclosure

This article is provided for general informational and educational purposes only and is not intended as legal, financial, or real estate advice. Real estate market conditions can change rapidly and may vary significantly by neighborhood, property type, price range, and individual circumstances.

All market data referenced herein is based on publicly available sources, third-party reports, and industry analyses believed to be reliable at the time of publication, but accuracy is not guaranteed. Figures such as median prices, inventory levels, days on market, and interest rates are subject to change without notice.

Nothing contained in this article should be relied upon as a guarantee of future market performance, property value, or investment outcome. Buyers and sellers are encouraged to consult with a licensed Nevada real estate professional, lender, attorney, or tax advisor to discuss their specific situation. Brokerage relationships are only created through a written agreement in compliance with Nevada Revised Statutes (NRS) and Nevada Real Estate Division (NRED) regulations

Real Estate In Nevada LLCis a Nevada-licensed real estate brokerage. This content does not constitute an offer to buy or sell real estate, nor does it establish a brokerage relationship.

Protecting Northern Nevada Homeowners from Real Estate Scams: Lessons and Best Practices We’ve Learned & Wish to Share

Real Estate In Nevada LLC & Rick Eaton (Managing Member & Retired Law Enforcement)

Over the past several years, we’ve seen a noticeable increase in scams affecting property owners, property managers, homeowners, and tenants here in Northern Nevada—often involving real properties, real addresses, and real financial losses. These aren’t just headlines from elsewhere; they are situations occurring in our own communities and within the real estate environment we all work in.

For most homeowners, their property represents their largest investment. Unfortunately, that also makes it an appealing target for deceptive activity such as fake rental listings, impersonation attempts, phishing messages, and payment fraud.

We’ve personally encountered situations where legitimate local rental listings were copied and reposted using the same photos but advertised at drastically reduced prices. The individual behind the fraudulent post posed as the owner and attempted to collect deposits and personal information from unsuspecting applicants. We’ve also seen properties exploited even when owners were not actively renting, simply through the reuse of older listing photos and publicly available data.

We’ve spoken directly with individuals who were both financially and emotionally impacted by these experiences, which is why we’ve tried to be more intentional about prevention.

Warning Signs We’ve Noticed

• Prospective tenants offering money before seeing the property

• Requests to bypass normal screening procedures

• Offers to overpay or prepay to create urgency

• Requests for wire transfers or unusual payment methods

• Messages seeking login credentials or financial information

Protective Practices That Have Helped Us

• Conducting full tenant screening (identity, credit, income, references)

• Using secure, traceable payment platforms

• Communicating through reputable listing and management systems

• Limiting the amount of personal data shared publicly

What We’ve Started Doing in Our Brokerage

With the increase in deceptive activity, we’ve added a few practical safeguards that have proven helpful:

• We now watermark all rental listing photos (other than MLS) with our office phone number across the images, which makes it harder for bad actors to reuse them in fraudulent ads.

• We post physical scam-warning notices at rental properties, advising the public how to verify legitimate listings and where to find accurate contact information.

• We encourage anyone who encounters a suspicious listing involving one of our properties to contact us directly before sending money or personal information.

These aren’t theoretical ideas—they’re steps we’ve used in real situations that have helped prevent confusion and reduce risk for both owners and applicants.

Where to Report Fraud (Nevada Resources)

If fraudulent activity is suspected, it can help to report it promptly to:

• Your local law enforcement agency

• FBI Internet Crime Complaint Center (IC3): https://www.ic3.gov

• Federal Trade Commission: https://reportfraud.ftc.gov

• Nevada Attorney General’s Office: https://ag.nv.gov → Consumer Complaints

Early reporting doesn’t always resolve every situation, but it can improve the chances of limiting damage and may help protect others as well.

Our Perspective

The goal isn’t fear—it’s awareness. Most transactions are legitimate and go smoothly. Still, we’ve found that informed homeowners and professionals are better equipped to spot issues early and avoid unnecessary problems.

At Real Estate In Nevada LLC, we see this as part of being good stewards of our clients’ trust. We’re sharing these experiences simply in case they are helpful to others in our industry. If something feels off, it’s worth slowing down, asking questions, and trusting your instincts.

Disclosure

This article is provided for general informational and educational purposes only. It does not constitute legal advice, law enforcement guidance, financial advice, or security services. Real Estate In Nevada LLC and its representatives are not acting as a substitute for law enforcement, legal counsel, or investigative professionals. While we share practical observations and risk-reduction practices based on real-world experience, readers should consult qualified professionals and report suspected criminal activity directly to appropriate authorities. No outcomes are guaranteed.

What the Latest Fannie Mae & Freddie Mac News Could Mean for Mortgage Rates

Could a $200B move by Fannie Mae and Freddie Mac affect mortgage rates? Here’s what home buyers and sellers should consider.

If you’ve been keeping even a casual eye on the housing market lately, you’ve probably noticed one thing: mortgage rates are back in the spotlight.

This week, a new announcement out of Washington added another layer to the conversation. President Donald Trump said he is directing Fannie Mae and Freddie Mac to purchase up to $200 billion in mortgage-backed securities. The goal sounds simple on the surface—help push mortgage rates lower. But what does that really mean for everyday buyers and sellers?

A quick look behind the curtain

Fannie Mae and Freddie Mac sit quietly behind the scenes of most home loans in America. When lenders make mortgages, these two government-sponsored enterprises often buy them, bundle them into mortgage-backed securities, and sell them to investors.

Think of it like this:

When Fannie and Freddie step in to buy more mortgages, lenders get their money back faster. With more cash available, lenders may be able to offer slightly better interest rates to new borrowers.

That’s the theory, at least.

President Trump also noted that because Fannie Mae and Freddie Mac were not privatized during his first term, they still have sizable cash reserves and the ability to intervene in the market this way.

Will this actually lower mortgage rates?

This is where opinions start to split. Some analysts believe that a large, credible purchase of mortgage-backed securities could help stabilize rates—or even nudge them lower—especially if financial markets believe this policy will stick around for a while.

Others are more skeptical. Fannie Mae and Freddie Mac are already close to regulatory limits on how much mortgage debt they can hold. On top of that, mortgage rates don’t move in a vacuum. Inflation, Federal Reserve policy, and global economic forces often have a much stronger pull.

In short, this announcement has potential—but it’s not a magic switch.

What should buyers take away from this?

For buyers, this is a reminder to stay prepared rather than reactive.

That means:

Keeping your pre-approval current

Watching rate movements, not headlines

Being ready to act if a favorable window opens

Even small changes in rates can make a meaningful difference in monthly payments over time.

And what about sellers?

For sellers, mortgage rates still matter—a lot.

Buyer demand tends to rise and fall with financing conditions. Even modest rate improvements can bring more buyers off the sidelines, while higher rates can thin the field. Staying aware of these shifts helps with pricing, timing, and strategy.

The bottom line

Right now, this announcement should be viewed as a possible influence, not a guarantee. Policy changes like this often take time to show real-world effects, and sometimes the impact is more subtle than headlines suggest.

We’ll continue monitoring developments closely and translating what matters into practical, real-world guidance for our clients here in Northern Nevada.

And if you’d like to talk through how current rate conditions affect your own buying or selling plans, feel free to contact us!

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

Disclaimer

This article is provided for general informational and educational purposes only and does not constitute legal, financial, or real estate advice. Real estate conditions may change quickly and can vary by location, property type, price range, and individual circumstances.

Market data referenced is based on publicly available sources and third-party reports believed to be reliable at the time of publication; however, accuracy is not guaranteed. Figures such as prices, inventory, days on market, and interest rates are subject to change without notice.

Nothing contained herein should be relied upon as a guarantee of future market performance, property value, or investment results. Buyers and sellers are encouraged to consult with a licensed Nevada real estate professional, lender, attorney, or tax advisor regarding their specific situation. Brokerage relationships are created only through a written agreement in compliance with Nevada Revised Statutes (NRS) and Nevada Real Estate Division (NRED) regulations.

Fannie Mae -No More Minimum Credit Score Requirement

✅ No More Minimum Credit Score Requirement

One of the biggest changes?

Fannie Mae has removed the minimum credit score requirement for loans submitted through its automated system (Desktop Underwriter), starting November 16, 2025. What does that mean for you?

The old “620 credit score” rule is gone

Lenders can now look at your entire financial picture

Income stability, payment history, and overall financial behavior matter more than a single number.

Credit still matters — but it’s no longer the gatekeeper it once was. (Some lenders may still have their own rules, but this is a major step forward.)

🏗 More Flexibility for Construction & New Builds

If you’re building a home or using a construction-to-permanent loan, there’s more good news: Credit documents can now be up to 18 months old and No minimum credit score is required for this exception. This gives buyers and builders more breathing room and fewer last-minute surprises.

🛡 Smoother Closings with “Day 1 Certainty”

Fannie Mae also expanded its Day 1 Certainty® program, which helps lenders feel more confident approving loans.

In simple terms:

✔ Fewer last-minute issues

✔ Less risk of surprises before closing

✔ A smoother path to the finish line

🏡 What This Means for You

These updates are all about making homeownership more accessible — especially for first-time buyers or anyone with a non-traditional financial history.

✔ More flexibility

✔ Fewer automatic disqualifiers

✔ A more human approach to lending

Every situation is unique, but overall, this is a very positive shift for buyers.

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

💬 Thinking About Buying?

If you’re curious how these changes could affect your buying power, we’re happy to help you explore your options and connect you with trusted local lenders. Smart guidance makes all the difference.

Contact Us! Were here to Help!

This article is provided for general informational purposes only and does not constitute legal, tax, financial, or real estate advice. Federal reporting requirements, including those issued by Fannie Mae , may vary by transaction and are subject to change.

Nothing in this article should be relied upon to determine whether a specific transaction is subject to reporting requirements. Buyers and sellers should consult a licensed Nevada real estate professional, settlement agent, attorney, or tax advisor regarding their individual situation.

Preparing Your Home for Sale in Reno–Sparks: A Smart Seller’s Guide for Today’s Market

Selling a home in today’s Reno–Sparks real estate market requires more than good timing—it requires strategy. While Northern Nevada remains attractive to buyers relocating from California, the Pacific Northwest, and beyond, today’s buyers are more deliberate, better informed, and less forgiving than they were during the frenzied market of a few years ago.

Homes that are well-prepared, properly priced, and professionally presented continue to sell efficiently. Those that are not often linger—and lose leverage. Here’s how savvy sellers are positioning their homes for success in the current Reno–Sparks market. Work with an experienced Reno-Sparks real estate professional.

First Impressions Matter—Especially in Northern Nevada

Curb appeal is still one of the strongest predictors of buyer interest, particularly in Reno and Sparks neighborhoods where buyers often tour multiple homes in a single day. In Northern Nevada, buyers pay close attention to exterior condition because it signals how well a home has been maintained through hot summers, cold winters, and seasonal weather swings.

Smart sellers focus on:

Fresh, low-maintenance landscaping suited to the high-desert climate

Clean walkways and driveways (winter wear is noticeable here)

A welcoming front entry—paint, lighting, and hardware matter

Addressing visible exterior issues such as peeling paint, cracked concrete, or worn trim

In competitive areas like Northwest Reno, Wingfield Springs, Spanish Springs, and South Reno, curb appeal often determines whether a buyer schedules a showing—or scrolls past. Contact Us For Assistance.

Declutter to Compete with Newer Inventory

Buyers in the Reno–Sparks market frequently compare resale homes to newer construction in surrounding areas. Decluttering helps level the playing field. The goal is not to make the home feel empty—but to make it feel spacious, bright, and adaptable.

Remove excess furniture to improve flow

Clear countertops, shelves, and closets

Depersonalize so buyers can envision their own lifestyle

Pay special attention to garages and storage—high priorities for Nevada buyers

Homes that feel open and orderly consistently photograph better and show better.

Handle Repairs Before Buyers Use Them as Negotiation Tools

In today’s market, buyers are cautious. Small issues often become big concerns during inspections.

Before listing, sellers should address:

Leaky faucets, running toilets, loose fixtures

Doors or windows that stick or don’t seal well

HVAC servicing—buyers routinely ask about system age and efficiency

Minor cosmetic issues like cracked tiles, worn caulking, or chipped paint

In Reno and Sparks, where energy efficiency and winter readiness matter, homes that feel “move-in ready” attract stronger offers and smoother escrows.

Photography Drives Online Traffic

Most buyers first encounter your home online—and often decide whether to tour it in seconds. In the Reno–Sparks market, listings with professional photography and staging consistently outperform those without, particularly as buyers compare homes across multiple neighborhoods.

Effective presentation includes:

High-quality photography that captures natural light and views

Video or virtual tours for relocating buyers

Twilight or drone photos when appropriate

Strong visuals don’t just attract more views—they attract more qualified buyers.

Strategic Pricing Is More Important Than Ever

Pricing correctly from the start is critical. While Northern Nevada continues to see steady demand, buyers are price-sensitive and data-driven.

Well-priced homes often generate:

More showings in the first two weeks

Stronger initial offers

Better negotiating position

Overpriced homes, by contrast, tend to sit—and price reductions often invite lower offers.

At Real Estate In Nevada, we will analyze:

Recent comparable sales (not just active listings)

Neighborhood-specific trends

Current days-on-market patterns

Seasonal demand and interest-rate impacts

In today’s market, momentum matters—and pricing sets the tone.

Nevada Disclosure Requirements: Get Them Right Early

Nevada law requires sellers to complete a Seller’s Real Property Disclosure Form (SRPD). Accuracy matters.

Disclosures typically cover:

Roof, plumbing, electrical, and HVAC systems

Past repairs or known defects

Insurance claims

HOA information, when applicable

Clear, complete disclosures reduce renegotiation risk and help transactions move smoothly toward closing.

Flexible Showings Increase Your Odds of Success

Many Reno–Sparks buyers view homes during evenings and weekends—especially those relocating or balancing work schedules. Sellers who keep their homes show-ready and accommodate reasonable showing requests often see better results.

Simple steps help:

Maintain consistent cleanliness

Set lighting and temperature comfortably

Minimize pets and strong odors

The easier it is to show your home, the more opportunities you create for the right buyer.

Final Takeaway: Preparation Creates Leverage

In the current Reno–Sparks real estate market, homes that sell best share common traits: thoughtful preparation, professional presentation, and realistic pricing.

Selling successfully isn’t about guessing the market—it’s about understanding it and positioning your home accordingly.

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

CONTACT US! With the right guidance and a strategic approach, sellers in Northern Nevada can still achieve excellent outcomes—even in a more balanced, more thoughtful market. Let Real Estate In Nevada LLC take ou to the finish line in marketing & selling your home!

Disclosure: Information provided is for general informational purposes only, reflects the author’s opinion, may change without notice, and should be independently verified. This is not legal, financial, or real estate advice. Readers should consult appropriate professionals regarding their specific circumstances.

A New Federal Rule Will Affect Some Nevada Real Estate Transactions in 2026

Beginning March 1, 2026, a new federal regulation will change how certain residential real estate transactions are reported across the United States, including here in Reno, Sparks, and Washoe County. The rule, issued by the Financial Crimes Enforcement Network (FinCEN), is designed to reduce money laundering and other financial crimes that can occur through real estate purchases.

For most everyday Nevada homebuyers and sellers, the impact will be minimal. However, transactions involving cash or non-traditional financing when property is purchased through a company or trust may require additional documentation and reporting.

Why This Matters in Northern Nevada

Washoe County has experienced steady population growth, out-of-state investment, and increased use of LLCs and trusts in real estate ownership. Until now, federal reporting rules applied only in select metro areas and above certain price points.

This new regulation replaces those limited programs with one nationwide standard, applying equally in Nevada and across the country, regardless of purchase price. The goal is consistency and transparency—not disruption of legitimate transactions.

Which Transactions Are Most Likely Affected

Most traditional home purchases made by individuals and financed through banks or credit unions will proceed exactly as they do today.

The rule primarily applies when residential property is transferred to a legal entity or trust and the purchase is not financed by a traditional institutional lender. This most often includes all-cash purchases, but it can also include some private or seller-financed transactions that don’t go through a regulated bank.

Simply put:

If you are buying a home in your own name with a standard mortgage, this rule likely does not apply to you.

What Types of Properties Are Included

The reporting requirement applies to common residential property types found throughout Washoe County, including single-family homes, condominiums, townhomes, one-to-four unit residential properties, vacant land intended for residential construction, and certain mixed-use residential properties.

What Information Is Reported — and What It Means

When a transaction falls under the rule, a report is filed with FinCEN that includes basic details about the property, the buyer and seller, and—when entities or trusts are involved—certain individuals who ultimately control or benefit from the purchase. It also includes general information about how the purchase was funded.

This reporting is administrative, not accusatory. Filing a report does not mean there is a problem with the transaction.

Who Handles the Reporting

In most Nevada transactions, the responsibility for filing the report falls on the closing or settlement agent, not the buyer or seller. Consumers may simply be asked to provide additional information during escrow.

In some cases, the professionals involved will determine who is best positioned to handle the reporting so it is completed efficiently and on time.

Important Exceptions to Know About

Many common life-event transactions are not the focus of this rule. Transfers related to estates, divorces, court orders, or similar situations are often treated differently under federal guidance. These are routine circumstances and generally not the types of transactions the rule is designed to scrutinize.

If a transfer feels personal, family-related, or court-directed, it may fall outside the rule or be handled with limited reporting.

What Buyers and Sellers in Washoe County Should Expect

If your transaction is affected, you may notice extra verification steps, questions about how funds are being transferred, or slightly longer processing during escrow. These steps typically occur after closing and are designed to improve transparency—not delay legitimate sales.

For most owner-occupied buyers and sellers, the process will feel familiar and unchanged.

Bottom Line for Northern Nevada

This new federal rule will not meaningfully affect most residential real estate transactions in Reno, Sparks, or greater Washoe County. However, buyers and sellers using cash or entity-based ownership structures should be aware that additional reporting requirements begin March 1, 2026.

If you believe your transaction may fall into this category, a brief conversation with your attorney, a licensed Nevada real estate professional or title/settlement agent early in the process can help ensure a smooth closing.

For official updates, FinCEN maintains public resources at fincen.gov.

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

CONTACT US - Were Here To Help!

This article is provided for general informational purposes only and does not constitute legal, tax, financial, or real estate advice. Federal reporting requirements, including those issued by FinCEN, may vary by transaction and are subject to change.Nothing in this article should be relied upon to determine whether a specific transaction is subject to reporting requirements. Buyers and sellers should consult a licensed Nevada real estate professional, and Title / settlement agent, attorney, or tax advisor regarding their individual situation.

Real Estate In Nevada LLC is a Nevada-licensed real estate brokerage. This content does not constitute an offer to buy or sell real estate, nor does it establish a brokerage relationship, which is created only through a written agreement in compliance with Nevada law and NRED regulations.

Reno–Sparks Real Estate Market Update: What 2026 Really Looks Like Thus Far

As we close out December 2025, many buyers and sellers in Reno, Sparks, and greater Washoe County are asking the same question: Is our local real estate market still strong?

The short answer is yes — but with important nuance. Rather than the overheated conditions of a few years ago, today’s market is best described as stable, resilient, and more balanced, shaped by affordability pressures, changing interest rates, and evolving buyer behavior. Below is a clear, data-supported look at where the market truly stands as we head into 2026.

Home Prices: Stable, Not Surging

Home values across Reno–Sparks have held firm through 2025, with modest year-over-year changes rather than dramatic spikes or declines.

Reno: Median home prices in late 2025 are hovering in the mid-$500,000 range, showing slight year-over-year growth depending on the data source.

Sparks: Median values remain around the low-to-mid $500,000s, generally flat to slightly up year over year.

Washoe County overall: Average home values remain near $550,000, indicating continued price support despite higher borrowing costs.

What this means in practical terms:

Prices are not falling, but they’re also not accelerating rapidly. Sellers can still expect solid values, while buyers are seeing fewer runaway bidding wars than in prior years.

Inventory: Still Limited, but More Balanced

Inventory remains tight by historical standards, though noticeably improved compared to the ultra-low supply levels of 2021–2022.

The Reno–Sparks area is currently operating around 2.5–3 months of housing supply.

While this still leans toward a seller-favored market, it represents greater balance than we’ve seen in recent years.

Buyers now have more choices, particularly in higher price brackets and properties that are not priced precisely to market.

This shift has introduced a healthier dynamic: well-priced homes still sell, while overpriced listings tend to sit longer or require adjustments.

Sales Activity & Days on Market

Sales activity remains steady, though less frenetic.

Homes are taking longer to sell on average than in the peak years, with days on market extending into the 60–80 day range in many segments.

Multiple offers still occur — but mostly on well-priced, well-presented homes in desirable neighborhoods.

Negotiations, price reductions, and seller concessions are more common than they were a year or two ago.

This is a sign of normalization, not weakness.

Interest Rates & Affordability

Mortgage interest rates remain a defining factor.

Rates throughout 2025 have generally hovered in the mid-6% range, well above pandemic-era lows.

Higher rates continue to impact affordability, especially for first-time buyers.

As a result, buyers are more selective, and monthly payment sensitivity plays a larger role in pricing decisions.

While rates have cooled demand somewhat, they have not stopped transactions — they’ve simply changed how buyers approach the market.

How December 2025 Compares to Previous Years

Compared to the past two Decembers:

Prices are holding, not retreating.

Inventory is higher, but still not excessive.

Sales pace has slowed, partly due to normal holiday seasonality and affordability pressures.

In other words, the market is neither booming nor busting — it is adjusting.

What This Means for Buyers and Sellers

More breathing room than in prior years

Greater opportunity for negotiation

Still competitive in certain price points and neighborhoods

Affordability remains the primary challenge

Homes priced correctly are still selling

Overpricing is more likely to lead to longer market times

Strategic pricing and strong presentation matter more than ever

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

CONTACT US! If you’re considering buying or selling in Northern Nevada, understanding these nuances can make all the difference.

Disclosure

This article is provided for general informational and educational purposes only and is not intended as legal, financial, or real estate advice. Real estate market conditions can change rapidly and may vary significantly by neighborhood, property type, price range, and individual circumstances.

All market data referenced herein is based on publicly available sources, third-party reports, and industry analyses believed to be reliable at the time of publication, but accuracy is not guaranteed. Figures such as median prices, inventory levels, days on market, and interest rates are subject to change without notice.

Nothing contained in this article should be relied upon as a guarantee of future market performance, property value, or investment outcome. Buyers and sellers are encouraged to consult with a licensed Nevada real estate professional, lender, attorney, or tax advisor to discuss their specific situation. Brokerage relationships are only created through a written agreement in compliance with Nevada Revised Statutes (NRS) and Nevada Real Estate Division (NRED) regulations

Real Estate In Nevada LLCis a Nevada-licensed real estate brokerage. This content does not constitute an offer to buy or sell real estate, nor does it establish a brokerage relationship.

Myth vs. Fact: Pre-Approval vs. Pre-Qualification

Myth vs. Fact: Pre-Approval vs. Pre-Qualification

Many homebuyers use the terms pre-qualification and pre-approval interchangeably, but they are not the same. Misunderstanding the difference can cost you time, negotiating leverage, or even the home you want.

What Is Pre-Qualification?

Pre-qualification is an informal first step based on information you self-report to a lender, such as estimated income, assets, debts, and credit score. Because no documents are verified, it’s fast and easy—often completed online or over the phone—but it only provides a rough affordability estimate and carries little weight with sellers. Think of pre-qualification as a starting point. It’s helpful for early planning, but it’s not a guarantee you’re cleared to move forward.

What Is Pre-Approval?

Pre-approval is a more rigorous and meaningful step. A lender reviews and verifies your financial documents, including income, assets, credit, employment, and debt-to-income ratio. After this review, the lender issues a written pre-approval letter stating the loan amount you’re approved for, subject to final conditions like appraisal and title. Pre-approval confirms your true buying power, helps identify potential issues early, strengthens your negotiating position, and signals financial readiness to sellers and listing agents.

Why Pre-Approval Matters in Competitive Markets

In competitive or low-inventory markets, sellers often receive multiple offers. A pre-approval can be the deciding factor—even over a higher price—because it reduces uncertainty. Sellers see pre-approved buyers as lower risk, more prepared, and more likely to close on time. In some cases, offers without pre-approval aren’t considered at all.

The Bottom Line

Pre-qualification offers a quick estimate for planning, while pre-approval reflects verified finances and real buying power. If you want your offer taken seriously, pre-approval is the gold standard.

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

Ready to Get Started?

Before you fall in love with a home—or start mentally arranging the furniture—make sure you’re truly ready to buy. Getting pre-approved early can save time, reduce stress, and help you act quickly when the right home appears.

Disclosure: Information provided is for general informational purposes only, reflects the author’s opinion, may change without notice, and should be independently verified. This is not legal, financial, or real estate advice. Readers should consult appropriate professionals regarding their specific circumstances.

Winter Home Appraisals: What Sellers Should Know

Myth vs. Fact: Pre-Approval vs. Pre-Qualification

Winter Home Appraisals: What Sellers Should Know

Winter appraisals can look a little different, but the goal remains the same: determining your home’s true market value based on condition, features, and recent comparable sales. While snow, shorter days, and dormant landscaping may change the visual presentation, appraisers are trained to look beyond the season and focus on the fundamentals that drive value.

Here are a few key things sellers should keep in mind during the winter months:

Curb Appeal Still Matters

Even in winter, first impressions count. Clear walkways and driveways, tidy entryways, and subtle seasonal greenery help an appraiser see that the property is safe, accessible, and well maintained. Removing ice, leaves, and debris also signals responsible ownership—something that always reflects positively.

Lighting Makes a Big Difference

With fewer daylight hours, interior lighting becomes especially important. Open blinds and curtains, turn on all lights, and use warm bulbs to make spaces feel bright and welcoming. Well-lit rooms appear larger, cleaner, and more inviting, which helps showcase the home’s layout and condition.

Winter Maintenance Is a Plus

A properly functioning home stands out in colder weather. Clean air filters, a well-running HVAC system, sealed windows, and visible upkeep reassure appraisers that the home has been cared for. If recent maintenance or upgrades have been completed—such as a serviced furnace or roof inspection—have documentation available to support the home’s condition.

Comparable Sales Still Drive Value

One important fact to remember is that appraisals are heavily influenced by recent comparable sales, even in winter. Appraisers adjust for seasonal differences and focus on similar homes sold in the same market area. A slower winter market doesn’t automatically mean lower value; it simply means fewer sales to analyze, making accurate presentation and documentation even more important.

Preparation Protects Your Value

Providing easy access to all areas of the home, including basements, garages, and mechanical rooms, helps the appraisal process move smoothly. A short list of upgrades, improvements, or unique features can also ensure nothing is overlooked. Small details, when clearly presented, can support a stronger and more accurate valuation.

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

A little preparation can make a real difference in your appraisal. Contact us for a no-obligation home value consultation and winter selling guidance.

Disclosure: Information provided is for general informational purposes only, reflects the author’s opinion, may change without notice, and should be independently verified. This is not legal, financial, or real estate advice. Readers should consult appropriate professionals regarding their specific circumstances.

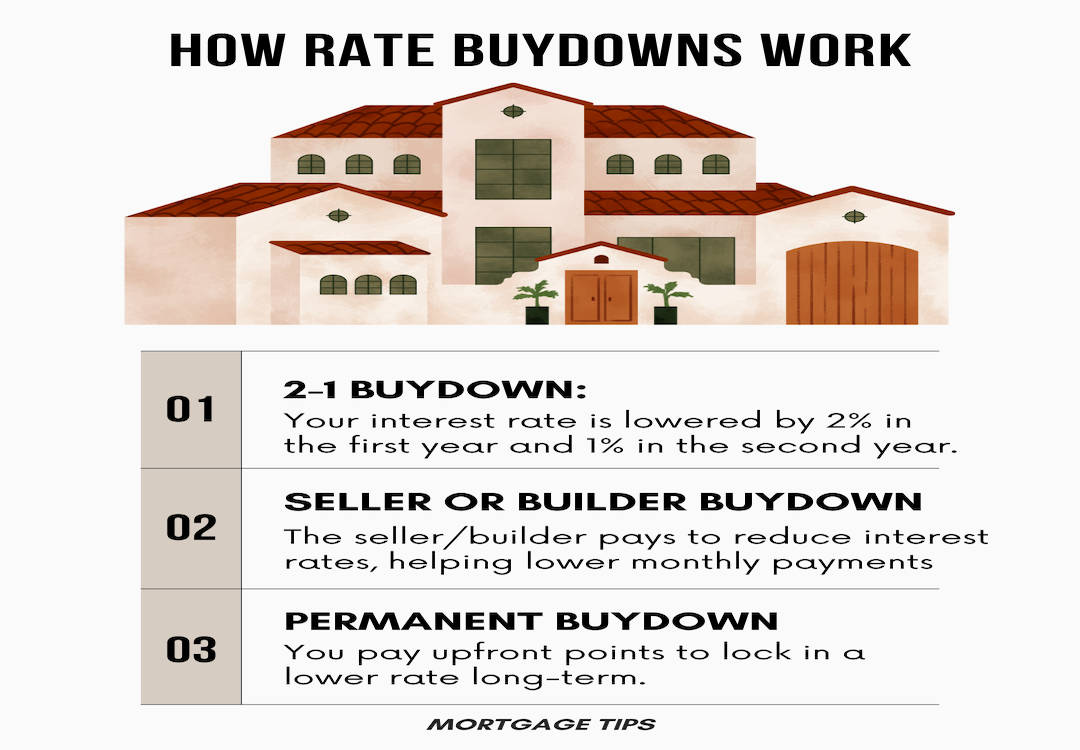

How Rate Buydowns Work

How Rate Buydowns Work

Common Types of Rate Buydowns

Temporary Buydown

With a 2-1 buydown, the interest rate is reduced by 2% in the first year and 1% in the second year. In year three, the loan adjusts back to the original note rate. This option is often used to help buyers ease into homeownership with lower initial payments, especially if they expect their income to increase or plan to refinance in the future.

Seller or Builder-Paid Buydown

In this scenario, the seller or builder contributes funds at closing to reduce the buyer’s interest rate. This approach can make a home more attractive without reducing the sales price and is commonly used in slower markets or new construction. For buyers, it means immediate monthly savings; for sellers, it can help a property stand out and move faster.

Permanent Buydown (Paying Mortgage Points)

A permanent buydown occurs when the buyer pays mortgage points at closing to secure a lower interest rate for the life of the loan. One point equals 1% of the loan amount. For example, on a $300,000 loan, one point would cost $3,000. Paying points can be especially beneficial for buyers who plan to stay in the home long term, as the monthly savings can outweigh the upfront cost over time.

Key Things Buyers Should Know

Rate buydowns must be structured and approved by the lender, and not all loan programs allow every type of buydown. Temporary buydowns require funds to be placed in an escrow account at closing, while permanent buydowns directly affect the loan’s interest rate. It’s also important to evaluate how long you plan to stay in the home, since that timeline often determines whether a buydown makes financial sense.

Why Buydowns Are Gaining Popularity

In many cases, a rate buydown can be more effective than a price reduction. Lowering the interest rate reduces the monthly payment immediately, which can improve debt-to-income ratios and overall buying power. For buyers focused on monthly affordability rather than purchase price alone, buydowns can be a smart and flexible solution.

Rate buydowns can be a powerful tool when used correctly, but the best option depends on your financial goals and timeline. Always consult with a trusted lender and real estate professional to explore which buydown strategy aligns with your long-term plans.

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

CONTACT US! - Were Here To Help

Disclosure: Information provided is for general informational purposes only, reflects the author’s opinion, may change without notice, and should be independently verified. This is not legal, financial, or real estate advice. Readers should consult appropriate professionals regarding their specific circumstances.

Seller’s Real Property Disclosure in Nevada: What Buyers and Sellers Should Know

Sellers Real Property Disclosures

In Nevada, the Seller’s Real Property Disclosure (SRPD) is not optional—it is a legal requirement governed by Nevada Revised Statutes (NRS) Chapter 113 and administered under guidelines set by the Nevada Real Estate Division (NRED). If you are buying or selling a residential property in Nevada, understanding this disclosure is essential.

What Is the Seller’s Real Property Disclosure?

The Seller’s Real Property Disclosure is a state-mandated written form in which the seller discloses any known defects or material facts that could affect the value or desirability of the property. Nevada law requires sellers to complete the official SRPD form approved by NRED and deliver it to the buyer before the buyer signs a purchase agreement, or as otherwise allowed under statute.

The disclosure is based on the seller’s actual knowledge. Sellers are not required to investigate or guess about conditions—but they must disclose known issues, even if those issues have been repaired.

What Must Be Disclosed Under Nevada Law

Under NRS Chapter 113, the disclosure typically addresses known conditions related to:

Roof, foundation, and structural components

Plumbing, electrical, heating, and cooling systems

Water intrusion, drainage, or flooding issues

Environmental or soil conditions

Appliances and mechanical systems included in the sale

Any other known material defects that may affect the property’s value or safety

Failure to disclose known defects can expose a seller to civil liability, including potential rescission or damages after closing.

Why the Disclosure Matters

For buyers, the SRPD provides critical insight into the home’s condition before committing to the purchase. It helps buyers make informed decisions, plan inspections, and understand potential risks or future expenses.

For sellers, a complete and honest disclosure demonstrates good faith, reduces surprises during escrow, and helps protect against post-sale disputes or legal claims.

What the Disclosure Is—and Is Not

The Seller’s Real Property Disclosure is not a warranty and not a replacement for a professional home inspection. Buyers are strongly encouraged to conduct their own inspections to identify conditions that may not be known to the seller. Likewise, sellers are only responsible for disclosing what they actually know at the time the form is completed.

Nevada Real Estate Division Guidance

NRED emphasizes that licensees must ensure the SRPD is properly completed, delivered, and acknowledged, but real estate agents do not complete the form for the seller. The responsibility for accuracy rests solely with the seller, making careful review and truthful responses essential.

Whether you’re preparing to sell or evaluating a purchase in Nevada, the Seller’s Real Property Disclosure plays a vital role in a transparent and legally compliant transaction. When completed correctly, it protects both parties and supports a smoother closing process.

Learn more about our approach to representation here:

Real Estate Decisions &. Read more about Nanette’s background and credentials here

Have questions about buying or selling a home in Nevada?

Reach out anytime—we’re here to guide you through every step with clarity and confidence.

Disclosure: Information provided is for general informational purposes only, reflects the author’s opinion, may change without notice, and should be independently verified. This is not legal, financial, or real estate advice. Readers should consult appropriate professionals regarding their specific circumstances